Longevity Analytics Explained

Moshe A. Milevsky is a leading authority on the intersection of wealth management, financial mathematics and insurance.

As a tenured professor in a business school he has one foot planted squarely in the ivory tower and the other in the commercial world, with a unique communication style and talent for explaining complex ideas clearly and with humor.

-

Speaking & Lectures

Speaking & LecturesLearn about his public keynote presentations and availability for speaking engagements.

-

University & Research

University & ResearchLearn about his teaching and research at the Schulich School of Business, York University.

-

Books & Writing

Books & WritingLearn about popular books and scholarly articles he has recently published.

-

Consulting & Disclosure

Consulting & DisclosureProf. Milevsky has interests in a number of commercial ventures, which are explained and disclosed here.

Moshe A. Milevsky is a tenured Professor of Finance at the Schulich School of Business and a member of the graduate faculty in the Department of Mathematics and Statistics at York University in Toronto, Canada.

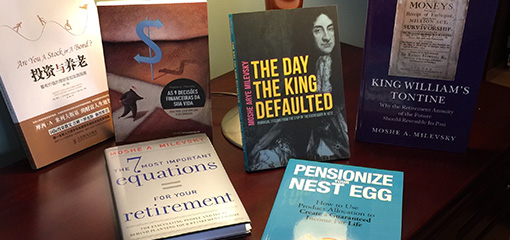

Moshe A. Milevsky has published 17 books (translated into 6 languages) and over sixty peer-reviewed scholarly papers in addition to hundreds of popular articles and blog pieces. In addition to being an award-winning author, he is a fin-tech entrepreneur with a number of U.S. patents and computational innovations in the retirement income space. He was named by Investment Advisor magazine as one of the 35 most influential people in the U.S. financial advisory business during the last 35 years, and he received a lifetime achievement award from the Retirement Income Industry Association.

My day-job at the University revolves around teaching undergraduate, graduate and doctoral students, courses on wealth management, investments, insurance, pensions and retirement planning.

As part of my academic responsibilities, I publish books, popular articles and technical papers, many of which you can download or link-to from this website.

My current research interests revolve around the area of financial history and the evolution of (retirement) insurance & annuity products over the centuries.